First Quarter and Improves Liquidity Position

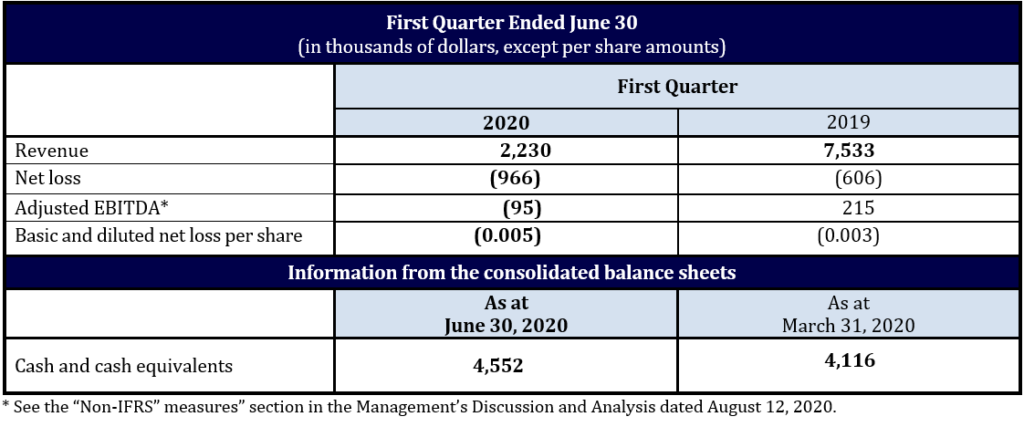

Financial Highlights

Highlights for the First Quarter Ended June 30, 2020

Compared with the fourth quarter ended June 30, 2019:

- Total revenues decreased from $7.5 million to $2.2 million as a result of the adverse impact of the COVID-19 pandemic.

- Recurring revenue decreased from $2.4 million to $0.1 million as a result of the adverse impact of the COVID-19 pandemic.

- Revenues related to systems sales from the entertainment market excluding home entertainment decreased from $2.7 million to $0.4 million.

- Revenues from home entertainment increased from $0.1 million to $0.2 million.

- Revenues from simulation and training decreased from $2.2 million to $1.5 million

- Net loss increased from $0.6 million to $1,0 million.

- Adjusted EBITDA* decreased from $0.2 million to ($0.1) million.

- Cash and cash equivalent was $4.6 million as at June 30, 2020 compared to $4.1 million as at March 31, 2020. Subsequent to the quarter, D-BOX closed a $2.0M financing, improving the cash position.

On July 24, 2020, the Corporation signed a definitive agreement with the National Bank of Canada [“NBC”] related to the availability of a line of credit amounting to $4 million for the ongoing operations and working capital of the Corporation. This line of credit will be renewable annually and will bear interest at prime rate plus 3.25%. The line of credit will be secured by first-ranking hypothec and security interests on all assets of the Corporation and its U.S. subsidiary, and will replace the three-year secured revolving credit facility with the NBC from which an amount of $4 million was drawn at June 30, 2020.

On July 24, 2020, the Corporation also signed a definitive agreement with the Business Development Bank of Canada [“BDC”] related to the availability of a working capital commercial loan of $2 million. This loan will bear interest at a variable rate, currently 4.55%, and will be payable in 24 monthly instalments of $33 thousand from June 2021 to May 2023 and by a final payment of $1.2 million in June 2023. The loan will be secured by second-ranking hypothec and security interests on all assets of the Corporation and its U.S. subsidiary.

" We are proud to close the financings and maintain a solid balance sheet in a very tough environment.”

David Montpetit, CFO of D-BOX

" We are proud to close the financings and maintain a solid balance sheet in a very tough environment. Considering exceptional cash collection and cash management strategies, we were able to improve our liquidity without even taking into account the contribution of the new financings,” said David Montpetit, CFO of D-BOX. “We will continue to monitor closely our liquidity, apply for support programs, and remain diligent on any spending.”

“During the quarter, we have started the execution of the D-BOX transformation plan. We are confident our technological platform will enable us to tap into the growing haptic market estimated at $38.6B by 2028, unlocking the value for D-BOX shareholders. While we remain committed to our existing markets, the COVID-19 pandemic has accelerated the opportunities in certain segments, in which we will allocate more resources such as the consumer market. As an example, sim racing at home has been gaining tremendous momentum and we are pleased with the immediate reception of a recent product launch.” said Mr. Sébastien Mailhot, President and CEO. “Lastly, I would like to reiterate our focus towards profitability. We have taken measures to reduce its cost structure last November to become profitable. While we remain committed to that goal, the timing remains uncertain because of the impact of the COVID-19 pandemic.”

Operational highlights

- the present time, D-BOX cannot reliably provide an estimate of the duration or magnitude of the outbreak and its impact on the Corporation’s financial results.

- estimated at 75 million fans in the United States. Top sim racing partners took advantage of the rise in interest driven by at-home entertainment. Partners such as SimLab, Vesaro, RSeat, VRX and Sim Seats, generated an increase in D-BOX system sales during the quarter.

- partner ECCO becoming the first full D-BOX auditorium in Austria’s capital city Vienna.

Additional information

The financial information relating to the first quarter ended June 30, 2020 should be read in conjunction with the Corporation’s unaudited condensed consolidated financial statements and the Management’s Discussion and Analysis dated August 12, 2020. These documents are available at www.sedar.com.

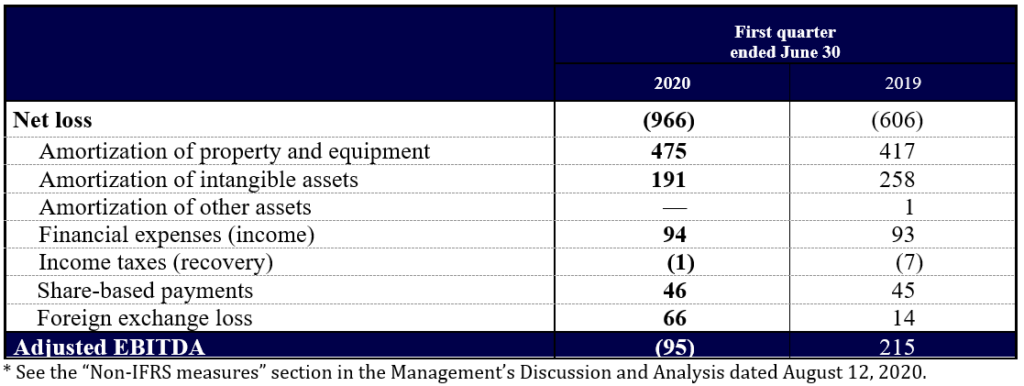

Reconciliation of adjusted ebitda to net income (loss)*

Adjusted EBITDA provides useful and complementary information, which can be used, in particular, to assess profitability and cash flows from operations. It consists of net income (loss) excluding amortization, financial expenses net of income, income taxes, impairment charges, share-based payments, foreign exchange loss (gain) and non-recurring expenses related to restructuring costs. The following table reconciles adjusted EBITDA to net loss:

All amounts are in thousands of Canadian dollars

Disclaimer regarding forward-looking statements

This news release contains statements that may constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information may include, among others, statements regarding the future plans, activities, objectives, operations, strategy, financial performance and condition of the Corporation, or the assumptions underlying any of the foregoing. In this news release, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur. Forward-looking information is based on information available at the time and/or management's good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Corporation’s control.

These risks, uncertainties and assumptions include, but are not limited to, those described under “Risk Factors” in the Corporation’s Annual Information Form for the fiscal year ended March 31, 2020, a copy of which is available on SEDAR at www.sedar.com, and could cause actual events or results to differ materially from those projected in any forward-looking statements. The Corporation does not intend, nor does the Corporation undertake any obligation, to update or revise any forward-looking information contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.

FOR FURTHER INFORMATION, PLEASE CONTACT:

David Montpetit

Chief Financial Officer

D-BOX Technologies Inc.

450 442-3003, ext. 296 dmontpetit@d-box.com

Steve Li

Vice President Investor Relations and Corporate Strategy

D-BOX Technologies Inc.

450 442-3003, ext. 403 sli@d-box.com