D-BOX Technologies reports first quarter 2024 results

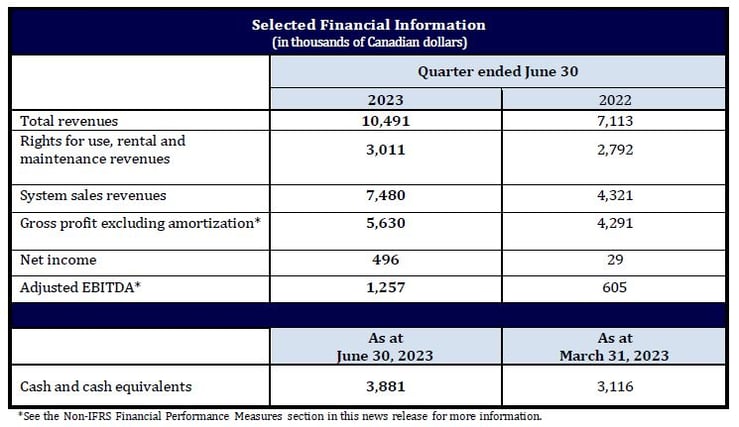

- Adjusted EBITDA* increased 108% to $1.3 million year-over-year

- Total revenues grew 47% to $10.5 million year-over-year

- System sales revenues increased 73% to $7.5 million year-over-year

- Rights for use, rental and maintenance revenues of $3.0 million – best on record

- Net income of $0.5 million, or $0.002 per share

Montréal, Québec, August 10, 2023 – D-BOX Technologies Inc. (“D-BOX” or the "Corporation") (TSX: DBO) a world leader in haptic and immersive experiences, today reported financial results for the first quarter ended June 30, 2023. All dollar amounts are expressed in Canadian currency.

“We continue to execute our plan for delivering profitable growth,” said Sébastien Mailhot, President and Chief Executive Officer of D BOX. “Following the strong revenue growth achieved in fiscal 2023, we are pleased to report our second-best quarter on record in terms of revenues, adjusted EBITDA, and net income. The first quarter was our strongest quarter yet for rights of use, rental and maintenance revenues. Moreover, our total revenue for the last four quarters amounted to $37.5 million, which is the highest for any four consecutive quarters in the history of D-BOX.”

“We are building momentum in multiple key markets. We continue to increase our footprint in theatrical, where our second quarter should benefit from the D-BOX releases of Barbie, Indiana Jones and the Dial of Destiny, Mission: Impossible – Dead Reckoning Part One, Gran Turismo, and others. We’re doing strong business in simulation and training, and gaining traction in racing / gaming, where we received initial revenues from the Motion 1 gaming chair during the quarter. Importantly, we see significant potential to grow our worldwide install base and industry-leading haptic ecosystem while delivering sustained profitable growth.”

FIRST QUARTER OVERVIEW

Revenue increased $3.4 million, or 47%, to $10.5 million compared with $7.1 million for the first quarter of last year. System sales grew by nearly $3.2 million, or 73%, driven by large increases in the entertainment and simulation and training markets. Simulation and training system sales increased by 153% to $2.9 million driven by growth in the transportation industry. Entertainment system sales increased by 44% to $4.5 million mostly due to expansion and growth in sim racing.

Rights for use, rental, and maintenance revenues reached a new quarterly record, increasing 8% to $3.0 million compared with $2.8 million for the same period last year. The growth was attributable to the Corporation’s increasing footprint in theaters, as well as a studio box office slate comparable to the same period last year.

Gross profit excluding amortization related to cost of goods sold increased to $5.6 million from $4.3 million for the first quarter of last year. Gross margin excluding amortization decreased to 54% from 60% a year ago due to a higher proportion (market mix) of system sales versus rights for use, rental and maintenance revenues compared to the same period last year. Rights for use, rental and maintenance revenues generate a higher margin than system sales.

Operating expenses for the quarter were $4.7 million, or 44.5% of revenues, compared to $3.8 million, or 53.7% of revenues in the first quarter of last year. The increase in operating expenses was mainly attributable to a $0.3 million increase in research and development expenses due to projects related to the next generation of actuator controllers and software development; a $0.2 million increase in selling and marketing expenses, due primarily to a $125 thousand reduction in government assistance during the period as compared to the same period last year; and a close to $0.3 million foreign exchange difference, driven by the volatility of the Canadian dollar relative to the U.S. currency between the periods. Marketing initiatives and participation in trade shows, business development events and travel focused on the entertainment and gaming markets also contributed to the increase in selling and marketing expenses.

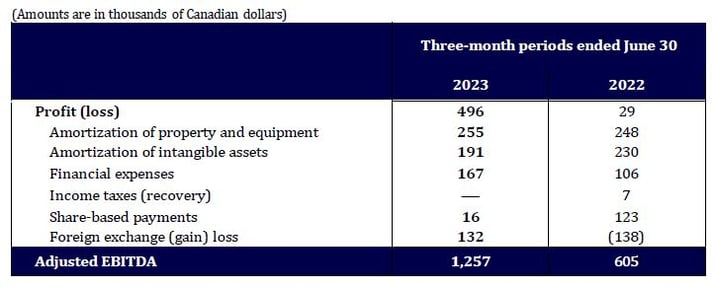

Adjusted EBITDA increased 107.8% to $1.3 million from $0.6 million in the first quarter of last year. Net income was $496 thousand (basic and diluted profit of $0.002 per share) compared with $29 thousand (basic and diluted profit of $0.000 per share) for the same period last year.

On June 30, 2023, D-BOX had working capital of $9.0 million, including cash and cash equivalents of $3.9 million, compared to working capital of $8.4 million and cash and cash equivalents of $3.1 million as at March 31, 2023.

NOTICE OF INVESTOR WEBINAR

Management of D-BOX will be participating in a Radius Research investor webinar on Friday, August 11, 2023, at 9:00 am ET. During the webinar, management will discuss D-BOX’s financial results for the first quarter and rolling four quarters, as well as recent developments in key markets. Anyone wishing to join the webinar may register at https://bit.ly/DBOX2024Q1.

ADDITIONAL INFORMATION REGARDING THE FIRST QUARTER ENDED JUNE 30, 2023

The financial information relating to the first quarter ended June 30, 2023, should be read in conjunction with the Corporation’s audited consolidated financial statements and the Management’s Discussion and Analysis dated August 10, 2023. These documents are available at www.sedar.com.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

D-BOX uses three non-IFRS financial performance measures in its MD&A and other communications. The non-IFRS measures do not have any standardized meaning prescribed by IFRS and are unlikely to be comparable to similarly titled measures reported by other companies. Investors are cautioned that the disclosure of these metrics is meant to add to, and not to replace, the discussion of financial results determined in accordance with IFRS. Management uses both IFRS and non-IFRS measures when planning, monitoring and evaluating the Corporation’s performance. The non-IFRS performance measures are described as follows:

1) EBITDA represents earnings before interest and financing, income taxes and depreciation and amortization. Adjustments to EBITDA are for items that are not necessarily reflective of the Corporation’s underlying operating performance. As there is no generally accepted method of calculating EBITDA, this measure is not necessarily comparable to similarly titled measures reported by other issuers. Adjusted EBITDA provides useful and complementary information, which can be used, in particular, to assess profitability and cash flows from operations. The following table reconciles adjusted EBITDA to profit (loss):

2) Gross profit excluding amortization and gross margin excluding amortization are both used to evaluate the Corporation’s capacity to generate funds through product sales by considering the cost of these products while excluding the main non-cash item, namely amortization (see the reconciliation table in section 5.2 of the Management’s Discussion and Analysis dated August 10, 2023).

ABOUT D-BOX

D-BOX creates and redefines realistic, immersive entertainment experiences by moving the body and sparking the imagination through effects: motion, vibration and texture. D-BOX has collaborated with some of the best companies in the world to deliver new ways to enhance great stories. Whether it’s movies, video games, music, relaxation, virtual reality applications, metaverse experience, themed entertainment or professional simulation, D-BOX creates a feeling of presence that makes life resonate like never before. D-BOX Technologies Inc. (TSX: DBO) is headquartered in Montreal with offices in Los Angeles, USA and Beijing, China. Visit D BOX.com.

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this press release may constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information may include, among others, statements regarding the future plans, activities, objectives, operations, strategy, business outlook, and financial performance and condition of the Corporation, or the assumptions underlying any of the foregoing. In this document, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. Forward-looking information, by its very nature, is subject to numerous risks and uncertainties and is based on several assumptions which give rise to the possibility that actual results could differ materially from the Corporation’s expectations expressed in or implied by such forward-looking information and no assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including but not limited to the future plans, activities, objectives, operations, strategy, business outlook and financial performance and condition of the Corporation.

Forward-looking information is provided in this press release for the purpose of giving information about Management’s current expectations and plans and allowing investors and others to get a better understanding of the Corporation’s operating environment. However, readers are cautioned that it may not be appropriate to use such forward-looking information for any other purpose.

Forward-looking information provided in this document is based on information available at the date hereof and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Corporation’s control.

The risks, uncertainties and assumptions that could cause actual results to differ materially from the Corporation’s expectations expressed in or implied by the forward-looking information include, but are not limited to: dependence on suppliers; concentration of clients; indebtedness; future funding requirements; access to content; global health crises; performance of content; distribution network; strategic alliances; competition; political, social and economic conditions; technology standardization; exchange rate between the Canadian dollar and the U.S. dollar; warranty, recalls and lawsuits; intellectual property; security and management of information; credit risk; reputational risk through social media; and dependence on key personnel and labour relations. These and other risk factors that could cause actual results to differ materially from expectations expressed in or implied by the forward-looking information are discussed under “Risk Factors” in the Corporation’s annual information form for the fiscal year ended March 31, 2023, a copy of which is available on SEDAR at www.sedar.com.

Except as may be required by Canadian securities laws, the Corporation does not intend nor does it undertake any obligation to update or revise any forward-looking information contained in the annual information form to reflect subsequent information, events, circumstances or otherwise.

The Corporation cautions readers that the risks described above are not the only ones that could have an impact on it. Additional risks and uncertainties not currently known to the Corporation or that the Corporation currently deems to be immaterial may also have a material adverse effect on the Corporation’s business, financial condition or results of operations.

CONTACT INFORMATION

David Montpetit

Chief Financial Officer – D-BOX Technologies Inc.

450-999-3216

dmontpetit@d-box.com

Trevor Heisler

Vice President Investor Relations – MBC Capital Markets Advisors

416-500-8061

investors@d-box.com